Ideas beneath

the surface

Redwood Turns Used EV Batteries into Low‑Cost Power for AI Data Centers

Redwood Turns Used EV Batteries into Low‑Cost Power for AI Data Centers

JB Straubel’s Redwood Materials has launched a new business line, Redwood Energy, which repurposes old EV batteries into low-cost (roughly 50% savings over new Lithium), fast-deployed (2x faster, could be years faster in some cases) energy storage systems for data centers. At an event at its Nevada campus last week, Redwood showcased a microgrid built from about 800 retired EV battery packs powering a 2k GPU data center operated by Crusoe. While the company’s recycling business continues to grow, I believe the Energy business will be the real growth driver going forward. Bottom line: credit JB for spotting a major opportunity. They’ve taken Redwood Energy from concept to first deployment in under a year, with a compelling value prop on both cost and speed. The next hurdle is getting big tech providers comfortable with the idea that used batteries can be just as reliable as new ones.

Key Takeaways

- Redwood Energy repurposes used EV batteries with ample remaining life into grid-scale energy storage.

- Data centers are facing an unprecedented power crunch. Second life batteries offer a cost-effective and timely solution that can be used by data centers for renewable energy or power backup.

- The market for stationary data center batteries is large and growing among major tech companies.

From Recycling to Energy

Taking a step back, Redwood was founded in 2017 and receives about 70% of all lithium-ion batteries in North America has (alt: has recycling market share) 90% of all lithium-ion battery recycling market-share in North America. That high market share means the company is taking in tens of thousands of EV batteries annually. Historically, the company has been breaking down those batteries, profitably recycling and selling the metals, and in the next year will begin production of cathode for sale to battery manufacturers. About a year ago, Straubel began to realize that a high percentage – more than 60% – of those batteries had greater than 70% of their life remaining. That meant those used batteries are ripe for a second life, and the concept of Redwood Energy was formed. Redwood’s moat is they’ve found a way to allow batteries from different manufacturers to work together in the same array.

It took about four months to build the largest second-life battery deployment in the world, which is generating a small amount of revenue. The key is that by using reclaimed batteries, the storage systems come at about half the cost of brand new lithium-ion battery projects, and can be deployed in about half the time. My sense is potential new customers will care little about the positive environmental impact and make their decisions almost entirely on cost of ownership and speed (big one because this is the major hurdle to deployment).

Since the system is built as an array, batteries whose performance is declining can be hot swapped with no downtime. In other words, from a performance standpoint, Redwood’s solution should perform on par with a new solution. Its worth noting, the Redwood Energy solution won’t always use solar given the systems can operate independently or be connected to the grid to manage peak loads or storing energy from intermittent sources.

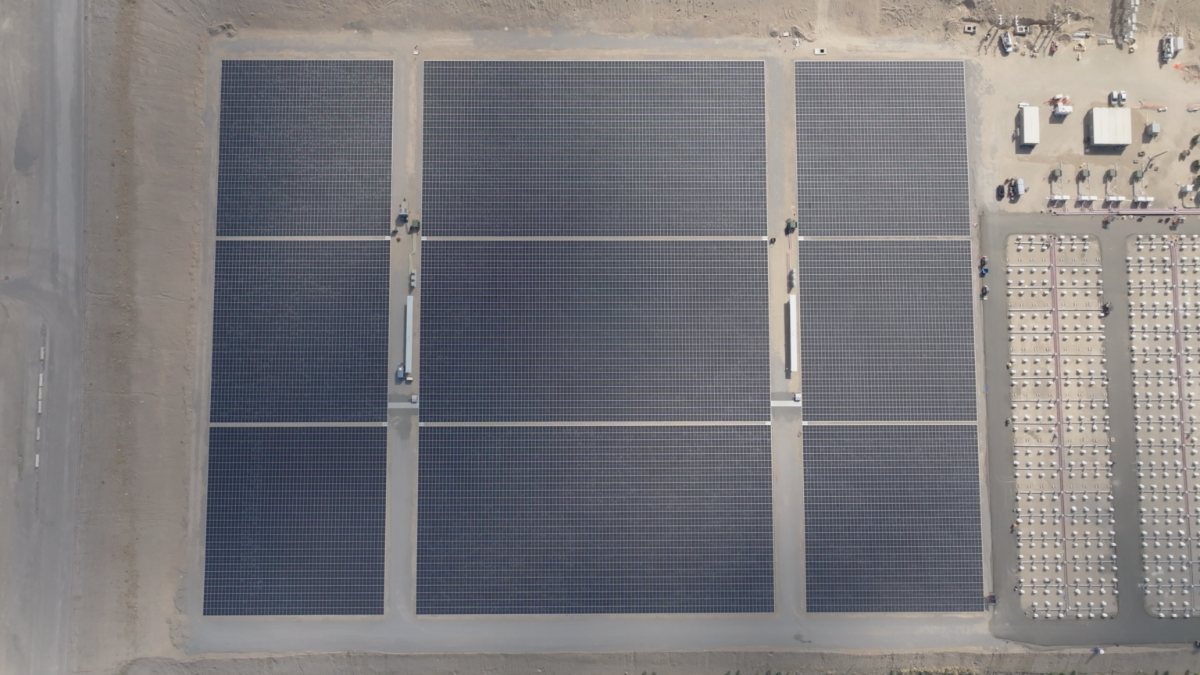

Here’s the solar. Note that it’s flat on the ground, a method to reduce cost and increase speed of deployment.

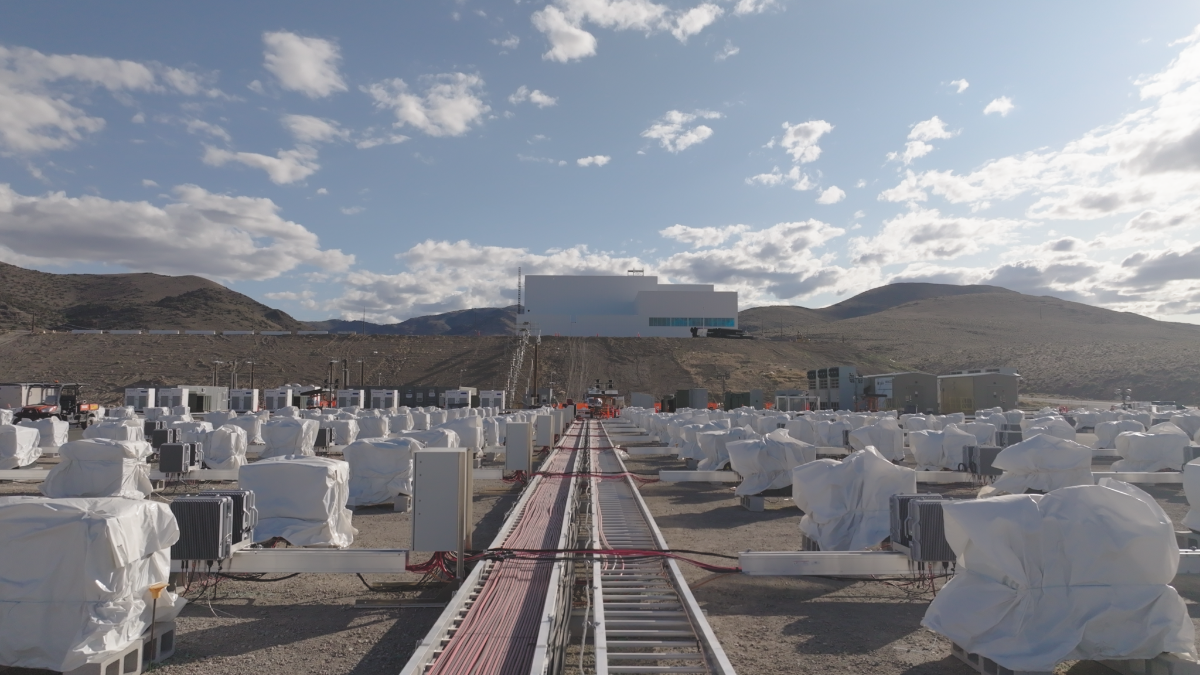

And the Crusoe 2k GPU data center.

Data Centers Need More Juice, Fast

It’s been known for the past two years that energy demand from data centers, especially AI clusters, is skyrocketing. We project that U.S. data centers could triple their electricity usage to as much as 12% of the nation’s demand by 2028, up from about 5% today. The problem is conventional power infrastructure isn’t keeping up. Setting up new grid connections or power plant capacity can take years, and traditional grid expansion alone won’t meet the upcoming demand. The three challenges:

- Renewable energy is an appealing way to supply these facilities because it’s much faster to get up and running, but it’s intermittent by nature, so batteries are essential to firm up solar and wind so data centers have round-the-clock power.

- Separately, data centers also require reliable backup power (historically provided by diesel generators) to prevent outages. Redwood’s battery packs can double as on-site backup. The 63 MWh storage at Redwood’s pilot can keep a 1 MW data center running for multiple days of cloudy weather.

- Lastly, getting a hold of new lithium-ion battery systems for stationary storage has become harder due to global supply constraints and trade uncertainties with China.

That means Redwood’s model sidesteps these bottlenecks by redeploying domestic used EV batteries.

The Market

By 2035, Deloitte forecasts that demand from AI data centers could increase to 123 GWh, up from about 4 GWh in 2024, about a 30× increase. Redwood plans to deploy 20 GWh of its repurposed battery storage by 2028. In other words, Redwood’s goal is to capture about 15% market share. During the event, Straubel hinted that multiple similar deployments are slated with other clients within the next year.

It’s easy to imagine who those future customers might be: mainly the hyperscalers, large co-location data center providers, and enterprise data centers.

The bottom line is credit JB for spotting a big opportunity. They’ve taken Redwood Energy from a concept to a first deployment in less than a year with a compelling cost and speed value prop. The next hurdle is getting big tech providers comfortable with the idea that using used batteries is just as good as using new ones.